AUTO

Be protected when the unexpected happens.

When accidents happen, you want to know that you, your family members, passengers and other drivers are protected.

Whether it be the fault of another driver, an avoidable accident, or the risk we all share on our roads.

FFIG will help you select the best coverage options, to best protect you.

We want our clients to have peace of mind and a policy that fits their needs.

TYPES OF AUTO COVERAGE

Collision Coverage

= Crash Related Damage to your car

Your car HITS another Vehicle or Object

Your car IS hit by another Vehicle

Your vehicle Rolls Over

Collision coverage will help cover damage to your vehicle up to the policy limit.

Comprehensive Coverage

= Unpredictable damages

Comprehensive coverage pays for a covered car that is stolen or damaged by causes other than collision. For example, damage caused by:

Fire

Hail

Windstorms

Vandalism

Impact by an Animal

Bodily Injury Liability Coverage

= Damage to others

Will cover legal defense.

If your found liable, coverage covers damage up to policy limit.

Covers injury to people, up to policy limits.

Bodily Injury Liability Coverage (cont.)

Can help pay for covered injuries you may have caused, (to other people) if in an accident. Protects against claims and lawsuits.

* If you’re found liable for an accident, your net worth can be at risk. The more assets you have, the more liability protection you will want. Be sure to inquire about an Umbrella Policy.

Property Damage

= Covers damages you caused in an accident, to another car and or property

Covers damages to another person’s car if your responsible for the accident, up to the policy limit.

Covers your legal defense, if the owner of the other vehicle you hit, decides to sue you.

Personal Injury Protection (PIP)

= Known as “No Fault Insurance”

Provides coverage regardless of who is at fault in an automobile accident.

If in an accident PIP will cover you, your family and any passengers.

Pays for covered medical & hospital expenses.

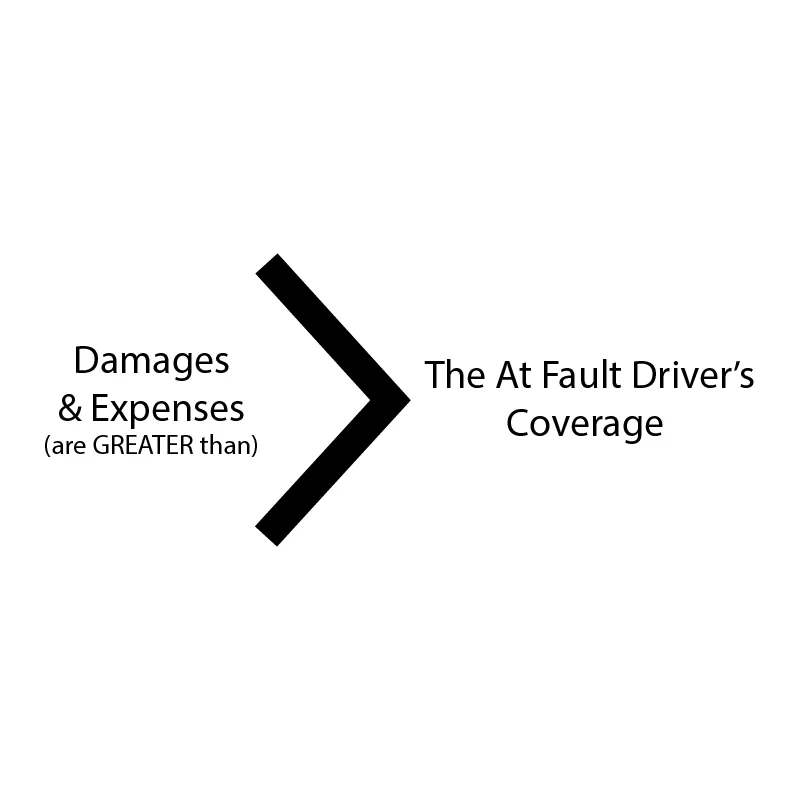

Uninsured / Underinsured Coverage

= Protects you against the risk of being HIT by an Uninsured or Underinsured Driver

Uninsured = (Other party/driver has NO Insurance)

Underinsured = (Other party/driver has inadequate/not enough insurance.

This coverage will help pay for your medical expenses caused by someone with inadequate or no coverage, if you the policy holder, have selected sufficient limits.

Also provides coverage if you (as a pedestrian) are hit by an uninsured driver.

Medical Payments Coverage

= Helps pay for medical expenses for you & your passengers in the event of an accident.

Covers medical expenses (up to policy limits), for anyone injured in your vehicle.

Coverage for you & your family members if another vehicle hits you as a pedestrian.

Let us Help you, SAFEGUARD the things you love!